Welcome to the New Age

Bank AL Habib Netbanking empowers you to manage all your finances with an enhanced platform that makes banking simple and easy. Whether you’re looking to check your balance, pay bills, transfer funds or print statements; our Netbanking and mobile app has got you covered.

3 Simple Steps to Start

Perform Transactions

Account Services

Balance Inquiry

Cheque Book Request

Cheques in Clearing

Change Password

Funds Transfer

Bill Payment

Account Usage

Online Self-Registration

One-time password for each transaction

Multiple Funds transfers

Multiple bill payments

Digital Statements

WHT Certificate

Online Stop Cheque

Credit Card Services

Balance Inquiry

Transaction details

Credit Card Payment

Account Statement

Enhanced Security Features

AL Habib Mobile and Netbanking is now equipped with a host of new security features in line with State Bank of Pakistan`s security guidelines. These security features are designed to safeguard you against potential digital banking scams and reflect the Bank`s commitment to provide you a safe banking experience.

Please note that biometric verification (in-App) is mandatory for you to proceed further, followed by a two-hour security buffer period if you perform any of the following actions on our digital banking platform. You may click on the below mentioned action items to access an info-guide.

User Guide for Support

To download the User Guide, please Click Here

Why is this upgrade important?

The two-hour security buffer implemented will give you time to reverse the changes in case the request has not been made by you.

To minimize any challenges while accessing your account digitally, we urge you to:

- Update your contact information with the Bank (registered mobile number/email address) if you intend to travel abroad.

- Register your new device as soon as possible.

Guidelines for New Security Controls

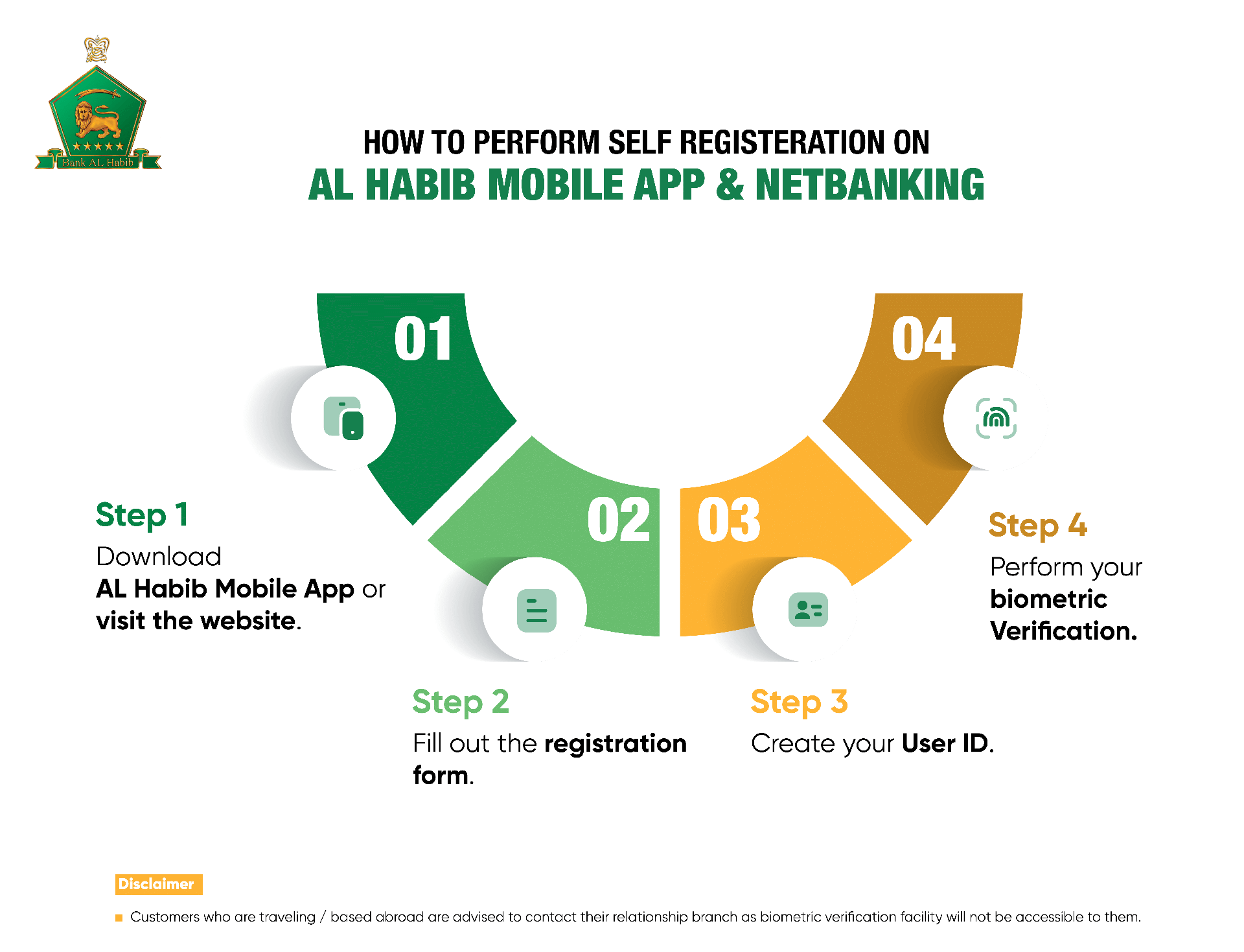

- How do I Sign Up?

- Fill in your details to create your ID, after which you must perform your in-App biometric verification.

- In case of biometric verification failure, you may visit any Bank AL Habib branch or perform your verification through AL Habib Biometric Verification App.

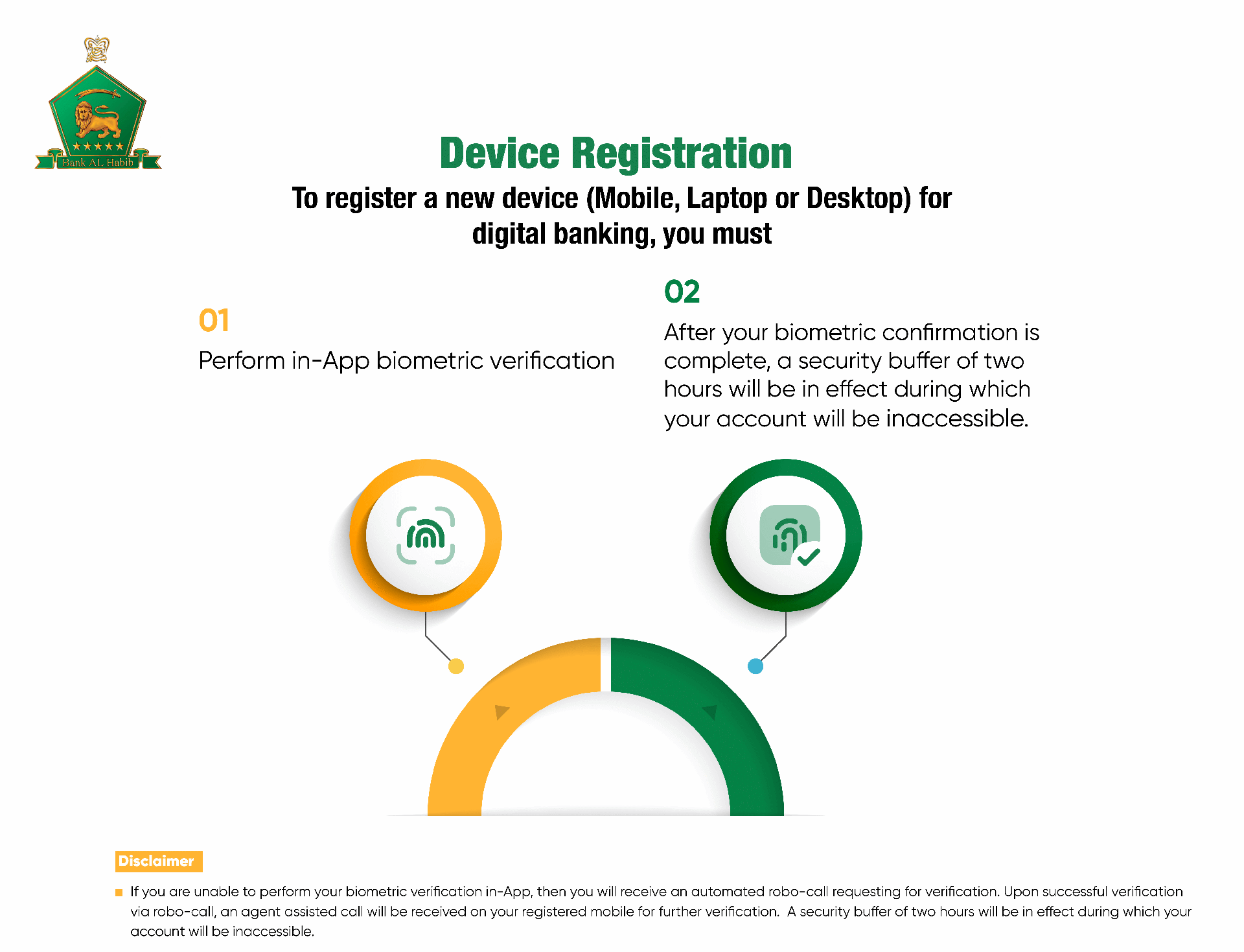

- What are the steps for Device Registration?

- For any new device registration, in-App biometric verification will be required.

- If your biometric verification is unsuccessful, an automated robo-call will be performed for verification, after which, a cooling off period of two hours will be in effect. During cooling off period, you will receive a call back for confirmation from our Call Center.

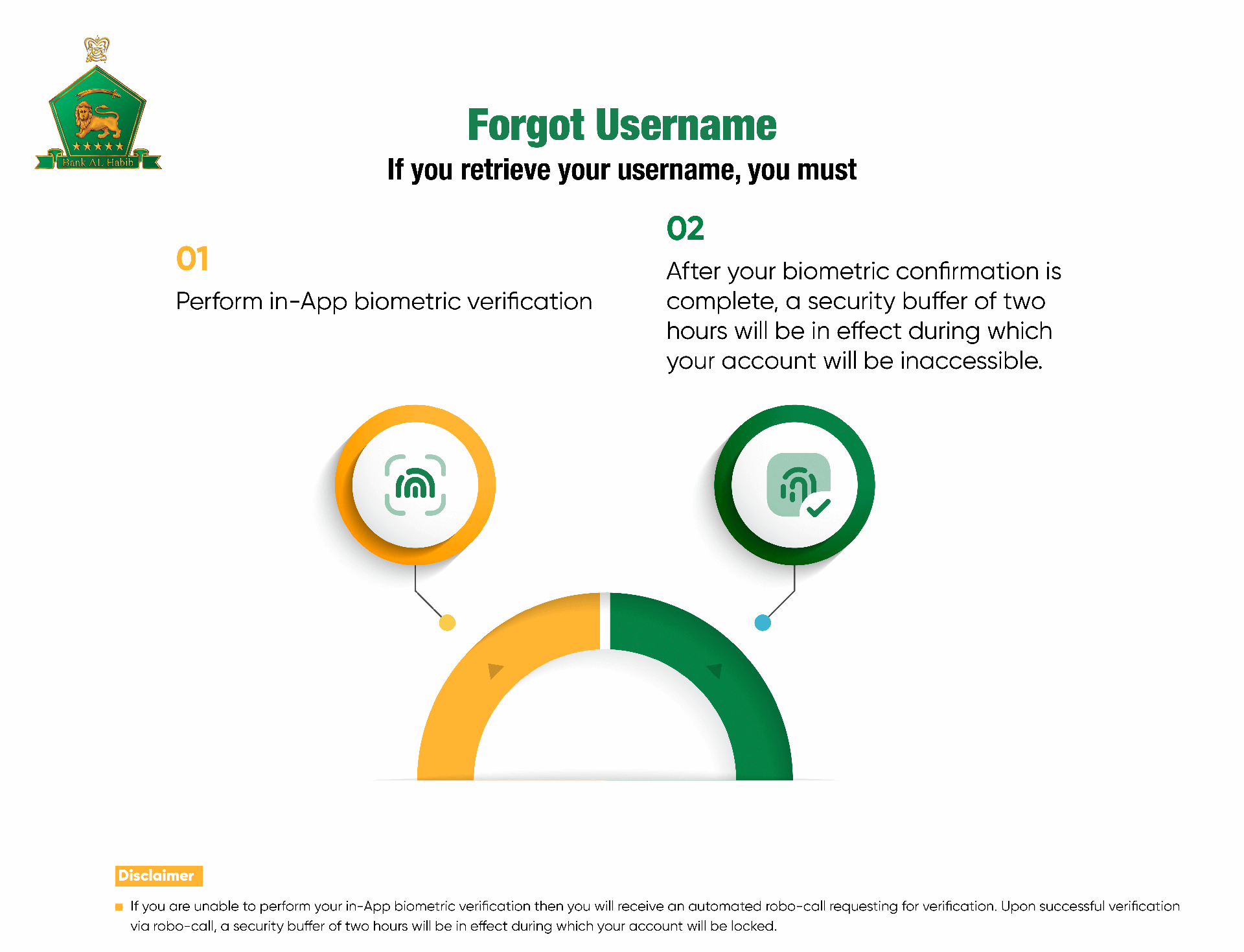

- What if I Forgot the Username?

- If you reset your username through an unregistered device, biometric verification will be required.

- In case of biometric verification failure, an automated robo-call will be executed.

- What if I forgot my Password?

- If you reset password through an unregistered device, biometric verification will be necessary.

- In case of biometric verification failure, customer will have to contact Call Center for assistance.

- What happens if I change my Transactional Limits?

- Debit Card limit management will now be enabled where you can customize limits as per your need, in addition to limit management for Funds Transfer for AL Habib Mobile / Netbanking which was previously available to you.

- The option to manage daily transactional limits of the Debit Card will be made available for Cash Withdrawal and Purchase (PoS and e-Commerce).

- Each time you change your AL Habib Mobile / Netbanking transaction limit, a cooling off period of two- hours will be activated.

- What Does This Change mean for Non-Resident Customers?

- If you are a Roshan Digital Account holder, you must contact your designated Relationship Managers for performing for biometric verification for Self Registration, or to get your ID unlocked.

- A robo-call will be received by Roshan Digital Account holders for verification of all changes, including device registration, password and username reset.

- If you are temporarily based outside Pakistan, you must contact your relationship branch to update your contact number.

Minimum Requirement Of Internet Browser For AL Habib Netbanking

The new Internet Banking service platform is a world renowned system with best in class features, and is named “Bank AL Habib Netbanking” providing you with more value added services and enhanced security features.

Google Chrome

Latest Version

Mozilla Firefox

Latest Version

Microsoft Edge

Latest Version

Apple Safari

Latest Version

Introducing the AL Habib Mobile Application

The new AL Habib Mobile App enables you to easily manage your finances on the go from almost anywhere! With a host of new features it is designed to make your digital banking experience more convenient, quick and secure.

What’s new:

- Multiple Funds Transfers

- Multiple Bill Payments

- Instant Stop Cheque Facility

- Credit Card bill payment of other banks through the 1BILL feature

- Withholding tax and Balance Certificate

- Forex Calculators

- Transaction Based OTP

- Retrieve User ID by using “Forgot User ID” option without calling the Helpline

- Set frequent payments as Favourites on the main dashboard

- If you are an iBanking user Click Here

To Download the App, head over to the Google Play Store for the Android version OR visit the App store to download the iOS version of AL Habib Mobile.

What is Device Binding?

Device Binding is a technology that extracts unique properties from the customer`s device to mark it as a Registered Device. It also notifies the customer of access to Net Banking/Mobile Application from an Untrusted Device. Additionally, if a customer marks a Device as a Trusted Device on OTP screen, then the OTP is not required by customer upon logging-in from their Registered Devices in future.

Key Features:

- Device Binding strengthens the security control and protects from real time fraud.

- Customers may bind more than one device and maximum of three devices as their Trusted Device.

- When Customer logs in from an Untrusted Device, Alert messages notifies that someone has logged in from an unauthorized device.

- Auto Read OTP feature is made available to customers, that reads OTP as received through SMS on Android Mobile devices.

Frequently Asked Questions

- What is AL Habib Netbanking / AL Habib MOBILE?

AL Habib Netbanking / AL Habib MOBILE is an upgrade to the existing AL Habib iBanking system with upgraded functionalities. You can instantly self-register to the application using Internet without the hassle of contacting the call center customer service.

The user receives a one-time password (OTP) on the registered phone number and email address for identity verification. After the quick verification, you can benefit from the convenient Netbanking / Mobile Banking and can manage finances with ease and security.

- Whats new in AL Habib Netbanking / AL Habib MOBILE?

Along with the common set of functionalities, the Key functionalities being introduced through Netbanking / Mobile Banking include the following:

- Quick Self Registration (without approaching the call center)

- One-time password for each transaction

- Multiple beneficiary transfers

- Multiple bill payments

- Digital bank statements, balance certificates and withholding tax certificates

- Cheque book issuance

- Stop Payment of Cheque (s)

- Account Maintenance Certificate, Account Proprietorship Certificate

- Supplementary Credit Card Details

- View Your Profile & Select Primary Account Number

- Retrieve User ID by using Forgot User ID option

- Forex Calculator & Term Deposit Calculator

- Alternate Login on Mobile App with PIN, Pattern & Fingerprint

- Face recognition feature for iOS users

- Debit Card Maintenance Module

- SMS Subscription, and added features

- Setting and View Payee Transaction Limits

- Setup Device binding

- ATM/Branch Locator

- What do I need to make use of AL Habib Netbanking / AL Habib MOBILE and how does it work?

Our AL Habib Netbanking / AL Habib MOBILE is easy to use. All you need is a personal computer, a laptop, or a mobile phone that is connected to the Internet and get started!

- What are the requirements to use AL Habib Netbanking / AL Habib MOBILE?

- You need an active Bank AL Habib account.

- You need a PC/ Laptop/ Mobile Phone Device with Internet access.

- You need to go over to the AL Habib NetBanking site or download the AL Habib MOBILE App from Play Store or Apple Store and self-register.

- How do I sign-up / self-register for AL Habib Netbanking / AL Habib MOBILE?

Signing-Up as New User:

New users that have an active account in Bank AL Habib, can register to AL Habib Netbanking service by following the below procedure:

- Visit the AL Habib Netbanking website at https://netbanking.bankalhabib.com

- Read the Security Recommendations, tick the checkbox, click accept, and then click on Register Now

- Fill in your details, enter captcha and click continue

- Enter the One Time Password (OTP) sent to your registered phone number and email address and click submit

- Once you accept the Terms & Conditions, you will be successfully registered, and a user ID will be created.

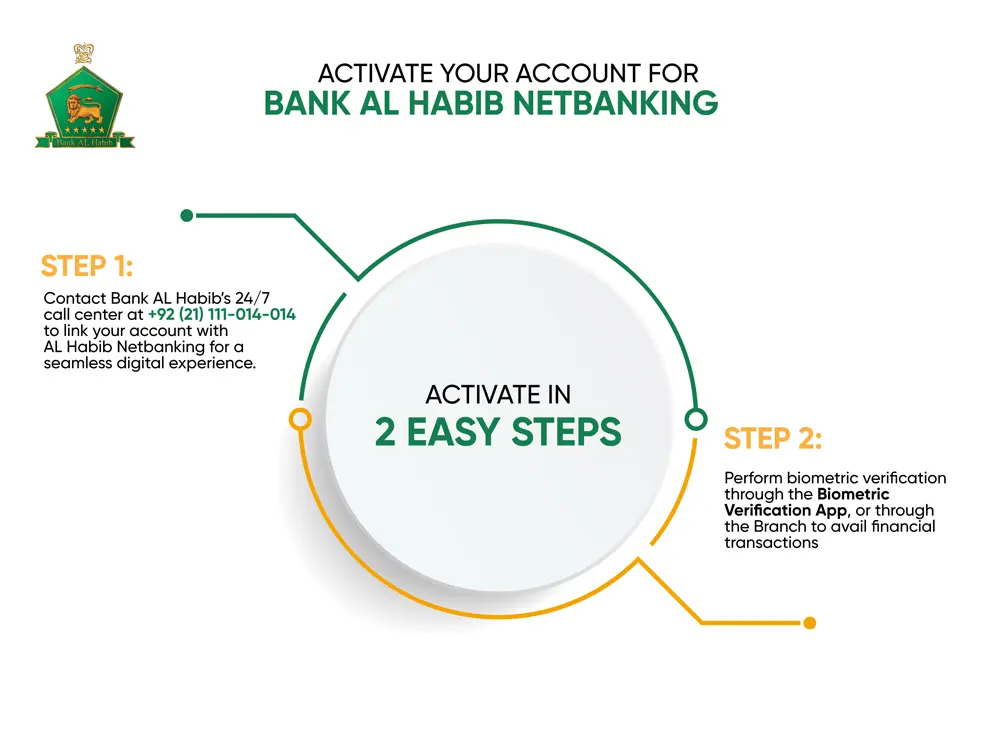

- Call Bank AL Habib's 24/7 call center at +92 (21) 111-014-014 to link your account with AL Habib Netbanking for a seamless digital experience.

- How secure is AL Habib Netbanking / AL Habib MOBILE?

The information you provide is kept strictly confidential. And the latest electronic encryption technology ensures the secure transfer of information over the Internet.

Because account security is important to us, we have built safety measures into AL Habib Netbanking / AL Habib MOBILE which reflect the importance of this issue.

You'll be allowed to change your own password, and all information sent and received is encrypted.

- How does Bank AL Habib make sure that only I can access my accounts?

You must enter OTP which is received only on your registered Mobile number or email address upon logging into AL Habib Netbanking / AL Habib MOBILE.

User may register their device as a trusted device to ensure a secure and safe login. Your password is confidential and should never be shared with anyone.

- What can I do to maximise security?

- Keep your password confidential.

- Never leave your device unattended while logged on to AL Habib Netbanking / AL Habib MOBILE

- Don't use your date of birth, telephone number, address, your name or the name of a friend or relative in your password.

- Never save your password in Web Browser.

- How often do I have to change my password?

We recommend that you change your password frequently. Your password is your 'key' to AL Habib Netbanking / AL Habib MOBILE, so it's important that you take precautions to keep it confidential. Under the Conditions of Use, you are obligated to protect your password. To change your password, use the 'Change Password' link from your side bar menu.

- How secure is AL Habib Netbanking / AL Habib MOBILE on a shared computer?

As long as you log out properly and maintain appropriate personal security procedures, your AL Habib Netbanking / AL Habib MOBILE can be just as secure on a shared computer as a personal computer.

- What if I forget my Username or Password?

In case of you forgot username or password of AL Habib Netbanking / AL Habib MOBILE account, click the following links on the login home screen to reset Username/Password:

- Forgot Username? Click the link to retrieve Username

- Forgot Password? Click the link to reset Password

- What is the daily limit of funds transfer?

Raast P2P / 1-link per day Transaction Limits in PKR Transaction Mode Transaction Limits Any Bank AL Habib Account PKR 2,000,000 Own Account PKR 4,000,000 Any other Bank Account via RAAST PKR 500,000 Any other Bank Account via 1-Link (IBFT) PKR 500,000 - What do I do if I notice an unauthorized transaction has gone through my account?

If you believe your AL Habib Netbanking / AL Habib MOBILE information has been compromised or you notice a transaction you did not initiate, you must contact your concerned branch, where your account is maintained or call (021) 111-014-014.

- If I transfer money today, can I take it out at the ATM?

If you transfer funds to your Bank AL Habib accounts, which allow access via the ATM, you will be able to withdraw any available funds immediately.

- Can I transfer money overseas?

No. To arrange an International Telegraphic Transfer, please contact your concerned branch, where your account is maintained

- Whom should I talk to when encountering trouble in using AL Habib Netbanking / AL Habib MOBILE during banking hours or after banking hours?

You should Contact your concerned branch, where your account is maintained during banking hours or call anytime (24 hours a day, 7 days a week) at (021)111 -014 – 014 for assistance and support. We look forward to serving you.

- Would I be having separate/multiple IDs for AL Habib Mobile App & Netbanking?

No, you cannot have multiple AL Habib Netbanking / AL Habib MOBILE IDs. Same Credentials are used on both web and mobile platforms.

- What is OTP?

OTP is “One Time Password” which is used to authenticate your transaction(s) and login.

- How can I block my AL Habib Netbanking / AL Habib MOBILE account?

You can block your AL Habib Netbanking / AL Habib MOBILE account by contacting our 24/7 Call Center at (021)111-014-014. After your successful verification on phone, our PBO will temporarily block your AL Habib Netbanking / AL Habib MOBILE account.

- Why do we need to create a Payee /beneficiary?

In order to perform different financial transactions, payee / beneficiary can be added in “Manage Payee & Billers” section. Once the payee / beneficiary is added you do not need to provide all the details every time transaction is initiated with the same payee / beneficiary, and no additional OTP is required. While for addition of each payee/beneficiary, an OTP will be required which is delivered to your registered email address and mobile number.

- How do I delete a beneficiary?

To delete a payee/beneficiary, go to the “Manage Payee & Billers” tab, select the payee you want to delete and click ‘delete payee’.

- What is Instant Funds Transfer?

You can perform funds transfer within Bank AL Habib or to any other 1Link member Bank in Pakistan through this option without adding a payee/beneficiary.

- How can I view funds transfer performed through AL Habib Netbanking / AL Habib MOBILE?

All funds transfer transactions performed through AL Habib Netbanking / AL Habib MOBILE are available under “Funds Transfer History” tab in “Payments & Transfers” section.

- How long does it take funds to get credited into the payee/beneficiary's account?

Funds are transferred instantly. However, if there is any delay, please contact our 24/7 Call Center at (021)111-014-014 or write to us at info@bankalhabib.com for assistance

- How can I do Multiple Funds Transfer?

You can use “Multiple Transfers” tab in “Payments & Transfers” section for multiple transfers to your added payee’s/ beneficiaries.

- Which banks I can transfer funds through AL Habib Netbanking / AL Habib MOBILE?

You can transfer funds to any Bank AL Habib account, as well as any 1-Link member bank's account.

Following is the list of banks:

- ADVANCE MICROFINANCE BANK

- ALBARAKA

- ALLIED BANK LIMITED

- APNA MICROFINANCE BANK

- ASKARI BANK LIMITED

- BANK ALFALAH LIMITED

- BANK OF KHYBER

- BANK OF PUNJAB

- BANK ISLAMI

- CITIBANK

- DUBAI ISLAMIC BANK

- FINCA

- FINJA EMI WALLET

- FAYSAL BANK LIMITED

- FIRST WOMEN BANK

- HABIB BANK LIMITED

- HABIB METROPOLITAN BANK

- ICBC

- JS BANK LIMITED

- KMBL KHUSHALI MICRO FINANCE BANK

- MCB ARIF HABIB SAVINGS

- MCB BANK LTD

- MCB ISLAMIC BANK LTD

- MEEZAN BANK LIMITED

- MOBILINK MICROFINANCE BANK

- NAYAPAY

- NBP FUNDS MANAGEMENT

- NRSP

- NATIONAL BANK OF PAKISTAN

- PAYMAX

- SAMBA

- SILK BANK

- SINDH BANK

- SONERI BANK

- STANDARD CHARTERD BANK

- SUMMIT BANK

- TELENOR MICROFINANCE BANK LTD

- THE FIRST MICROFINANCE BANK LTD

- U MICROFINANCE BANK

- UNITED BANK LIMITED

- ZARAI TARAQYATI BANK LTD

- How can I do Multiple Bill Payments?

You can use “Multiple Bill Payments” tab in “Payments & Transfers” section for multiple payments against your registered billers

- How can I stop payment to a Cheque?

You can stop payment of your cheque(s) by selecting “Stop Cheque” option. Cheque(s) can be stopped through Cheque Number and/or Range (From – To).

- How can I do cheque Inquiry?

You can check your cheque(s) status by selecting “Cheque Inquiry” option. Cheque(s) inquiry can be performed through Cheque Number, Range (From – To) and/or Cheque Status.

- How can I request for Withholding Tax / Balance Certificate through AL Habib Netbanking / AL Habib MOBILE?

You can initiate a request by selecting “With Holding Tax/Balance Certificate” option in certificates section. Requested certificate will be sent to you at your registered email address within 30 minutes.

- How can I link my other accounts with AL Habib Netbanking / AL Habib MOBILE?

You can link your other account(s) by contacting our 24/7 Call Center at (021)111-014-014

- What should I do if I have any issue or query regarding AL Habib Netbanking / AL Habib MOBILE?

Please contact our 24/7 Call Center at (+92-21)111-014-014 for assistance.

- Which billers can I pay using AL Habib Netbanking / AL Habib MOBILE?

You can pay bills for the following Billers:

All Companies 1-Bill Other Bank Credit Card Bill, Invoice/Voucher Payment, Top-up & Variable Payments Aggregator Kuickpay, PayPro, Haball Clubs Creek Club, Dreamworld, Karachi Boat Club, Karachi Club Corporate / Dealer Payments Tapal Tea Pvt Ltd DHA Payments DHA IR, DHA Lahore Electricity GEPCO, HESCO, KE New Connection, Kelectric, LESCO, MEPCO, PESCO, SEPCO Fertilizers Engro Fertilizer Gas SNGPL, SSGC Gov of Punjab Tax PRA Insurance ALICO, EFU Insurance - Conventional, EFU Insurance - Takaful, Jubilee Life Insurance - ADHOC, Jubilee Life Insurance - INDEX, Jubilee Life Insurance - NON INDEX, PAKQATAR GENERAL TAKAFUL, PAKQATAR Family Takaful Renewal, PAKQATAR Family Takaful TopUp Internet 1LOAD, NAYATEL, Qubee, Qubee Distributor, Wateen, WORLD CALL, Wi-Tribe Investment AKD Investment, Askari Investment Management Ltd, MCB-Arif Habib Savings and Investments Ltd, AL Meezan Investment, UBL Fund Managers Online Store Mobilink Jazz Cash PTCL PTCL LandLine, PTCL Evo Prepaid, PTCL Evo Postpaid, PTCL Defaulter, PTCL Vfone Residential Pay (Maint/Rent/Install) Askari Colony, Askari-V, Karachi Schools / Colleges Aitchison College, Beaconhouse School System, Green Shield Public School, Haque Academy, Habib Public School, Habib Girls School, Karachi Public School, Links Education Foundation, LUMS, IBA - Karachi, New Generation High School, New Generations School, United Medical and Dental College UM PSGH PLTD, Head Start Pvt Ltd, Green Island Fnd School SECP Payments SECP Shipping Companies DP World Tax Payment FBR, SRB Telco Post Paid Companies Mobilink Post Paid, Telenor Post Paid, Ufone Post Paid, Zong Post Paid Telco Pre Paid Companies Mobilink Pre Paid, Telenor Pre Paid, Ufone Pre Paid, Ufone Supercard, Zong Pre Paid Traveling Daewoo Express, Careem Ufone Franchise Ufone Franchise North, Ufone Franchise Central1, Ufone Franchise Central2, Ufone Franchise South Water and Sewerage FWASA, KWSB, HWASA Welfare Sindh Worker Welfare Fund - What are the limits for Mobile top-ups?

Following are the per transaction limits for Mobile Top Ups Postpaid:

Postpaid Telecom Company Amount Limit Mobilink PKR 500 to PKR 100,000 Telenor PKR 50 to PKR 5,000 Ufone PKR 500 to PKR 5,000 Zong PKR 50 to PKR 20,000 Following are the per transaction limits for Mobile Top Ups Prepaid:

Prepaid Telecom Company Amount Limit Mobilink PKR 30 to PKR 5,000 Telenor PKR 50 to PKR 5,000 Ufone PKR 50 to PKR 5,000 Zong PKR 50 to PKR 5,000 - What is the Minimum Requirement of Internet Browser for AL Habib Netbanking?

Please use the latest version of following Internet Browsers for seamless Netbanking experience.

- Google Chrome

- Firefox

- Microsoft Edge

- Apple Safari

- What is Device Binding?

Device Binding is a technology that extracts unique properties from the customer`s device to mark it as a Registered Device. It also notifies the customer of access to AL Habib Netbanking / AL Habib MOBILE from an Untrusted Device.

Additionally, if a customer marks a Device as a Trusted Device on OTP screen, then the OTP is not required by customer upon logging-in from their Registered Devices in future.

- Device Binding strengthens the security control and protects from real time fraud.

- Customers may bind more than one device and maximum of three devices as their Trusted Device.

- When Customer logs in from an Untrusted Device, Alert messages notifies that someone has logged in from an untrusted device.

- Auto Read OTP feature is made available to customers, that reads OTP as received through SMS on Android Mobile devices.

- How do I update my email address and/or mobile number on AL Habib Netbanking / AL Habib MOBILE?

You have to visit your BAHL relationship branch and submit Record Updation Form to update your email address and/or mobile number. Your email address and/or mobile number will be updated within 3 working days.

- I suspect someone has access to my AL Habib Netbanking / AL Habib MOBILE account. What should I do?

Immediately contact our 24/7 Call Centre at (+92-21)111-014-014 to temporarily block your AL Habib Netbanking / AL Habib MOBILE Account.

- How can I unblock my AL Habib Netbanking / AL Habib MOBILE account?

For unblocking of AL Habib Netbanking / AL Habib MOBILE account, you are required to contact our 24/7 Call Center at (+92-21)111-014-014 from your registered number. After your successful verification on phone, our PBO (Phone Banking Officer) will un-block your AL Habib Netbanking / AL Habib MOBILE account.

- Which Account Holders can utilize AL Habib Netbanking / AL Habib MOBILE?

All Bank AL Habib active CASA account holders maintaining following types of accounts with valid CNIC/Passport can use this service.

- Individual

- Sole proprietor

- Joint Account (Either or Survivor)

- Can I have my Password Reset via Call Center?

In case you have forgotten your password, you can also contact our 24/7 Call Center at (+92-21)111-014-014 to receive system generated password on registered email address. Your password is confidential and should never be shared with anyone.

- Can I change my User ID / Password?

You cannot change your User ID; however, you may change your password through the 'Change Password' option.

- What is the length of duration for which I can view my Account Statement?

You can view your Account Statement for last 6 months Using View Statement Option. However, you can also request for Account Statement for last 3 years through Request Statement Option, which is then sent to you on your registered email address.

- Does Bank AL Habib charge to use the AL Habib Netbanking / AL Habib MOBILE?

At present AL Habib Netbanking / AL Habib MOBILE is FREE. However; Bank reserves the right to apply charges anytime through its Schedule of Charges.

- How can I check if an additional transaction has been executed from my account after performing the Funds Transfer transaction?

You are advised to check your E-Statement after every transaction to ensure all the transactions are correct and up to date.